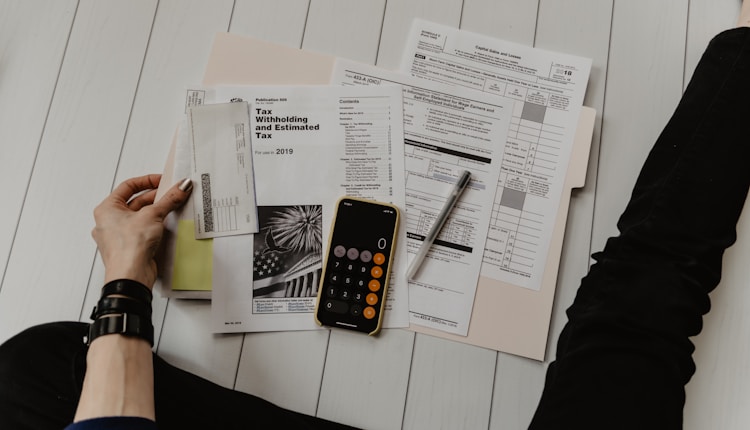

Join My 3-Day “Pay No Tax” Challenge and Learn the Exact Strategies the Wealthy Use to Legally Eliminate Taxes!

You work hard. -You earn well. -So why are you handing tens of thousands of dollars to the IRS every year?

It’s not because you’re doing anything wrong — it’s because you haven’t been shown how to move like the wealthy.

In this 3-day challenge, The Tax Strategist, will guide you through the exact structures and strategies the top 1% use to legally reduce, defer, and even eliminate taxes — so you can finally stop overpaying and start building real wealth.